ON-DEMAND-PAY

Get paid at the pace of real life

HOW IT WORKS

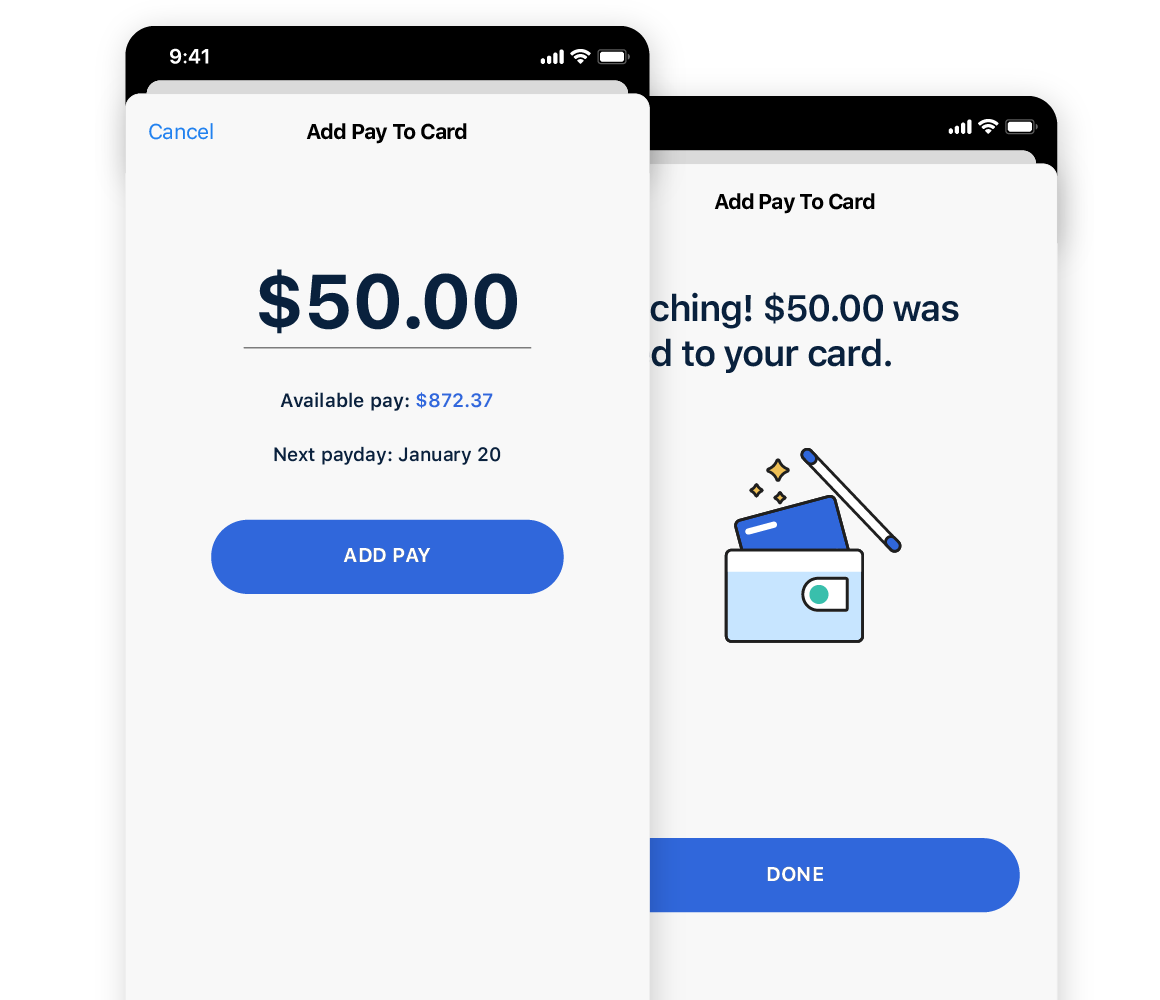

Access the money you earn instantly

Understanding Available Earned Pay

Available earned pay grows when you complete shifts or workdays

Available earned pay shrinks when your taxes and deductions are processed

Some employers have caps or frequency limits on using available earned pay—reach out to your payroll department with questions

Ready to make any day payday?

1. Some blackout dates and limitations may apply based on your employer's pay cycle and configurations.

2. Consult the Cardholder Agreement and Fee Schedule for a complete list of fees.

The Dayforce Wallet Prepaid Mastercard® is issued by Peoples Trust Company under licence from Mastercard International Incorporated. Funds loaded onto the card are held by the issuer Peoples Trust Company, a member institution of the CDIC, and are eligible for CDIC coverage. Dayforce Canada Ltd. is not a CDIC member institution. Funds loaded onto the card are combined with eligible deposits held under Peoples Trust Company for up to $100,000 of deposit protection, per insured category, per depositor. For further information about CDIC deposit insurance, please consult CDIC’s website cdic.ca. Certain fees, terms, and conditions are associated with the approval, maintenance, and use of the card. You should consult your Cardholder Agreement and Fee Schedule. If you have any questions regarding the Card or such fees, terms, and conditions, contact Customer Support at 1-888-999-6824, Monday – Saturday, 8 am EST – 6 pm EST.